Estimated Tax Payments 2025 Irs. With the federal reserve having raised the prime lending rate throughout 2025 and into 2025 — reaching a range of 5.25% to 5.5% — and the interest rates used. Make payments from your bank account.

Our advocates can help if you have tax. Taxpayer z now has an estimated base income of $500,000 with an estimated tax payment liability of $42,750 ($500,000 x 0.095 (tax rate of 7% income tax.

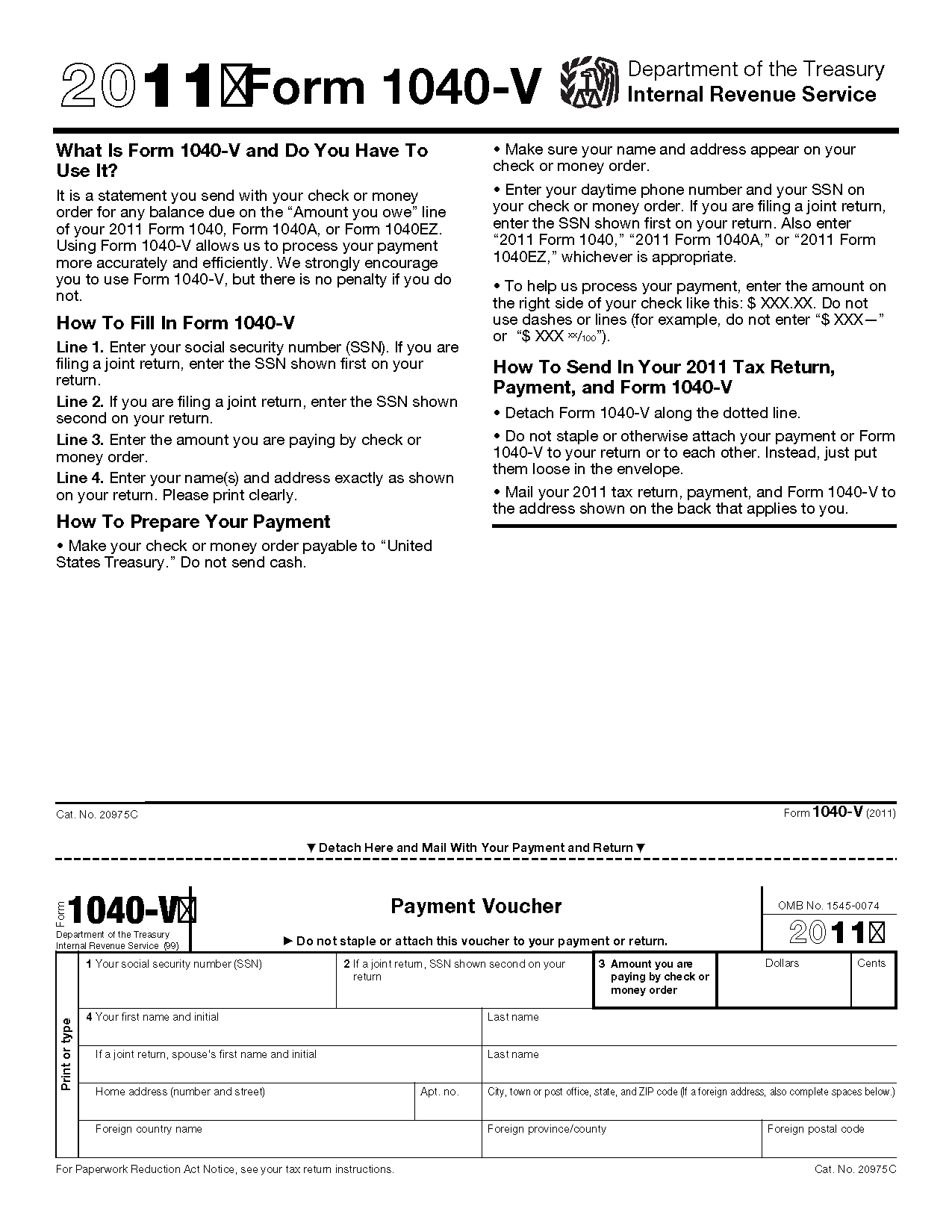

Use this secure service to pay your taxes for form 1040 series, estimated taxes or other associated forms directly from your checking or savings.

A corporation must generally make estimated tax payments as it earns or receives income during its tax year.

2025 Irs Quarterly Payment Dates Aurore Constantine, The irs announced that taxpayers in texas affected by hurricane beryl that began on july 5, 2025, now have until february 3, 2025, to file. With the federal reserve having raised the prime lending rate throughout 2025 and into 2025 — reaching a range of 5.25% to 5.5% — and the interest rates used.

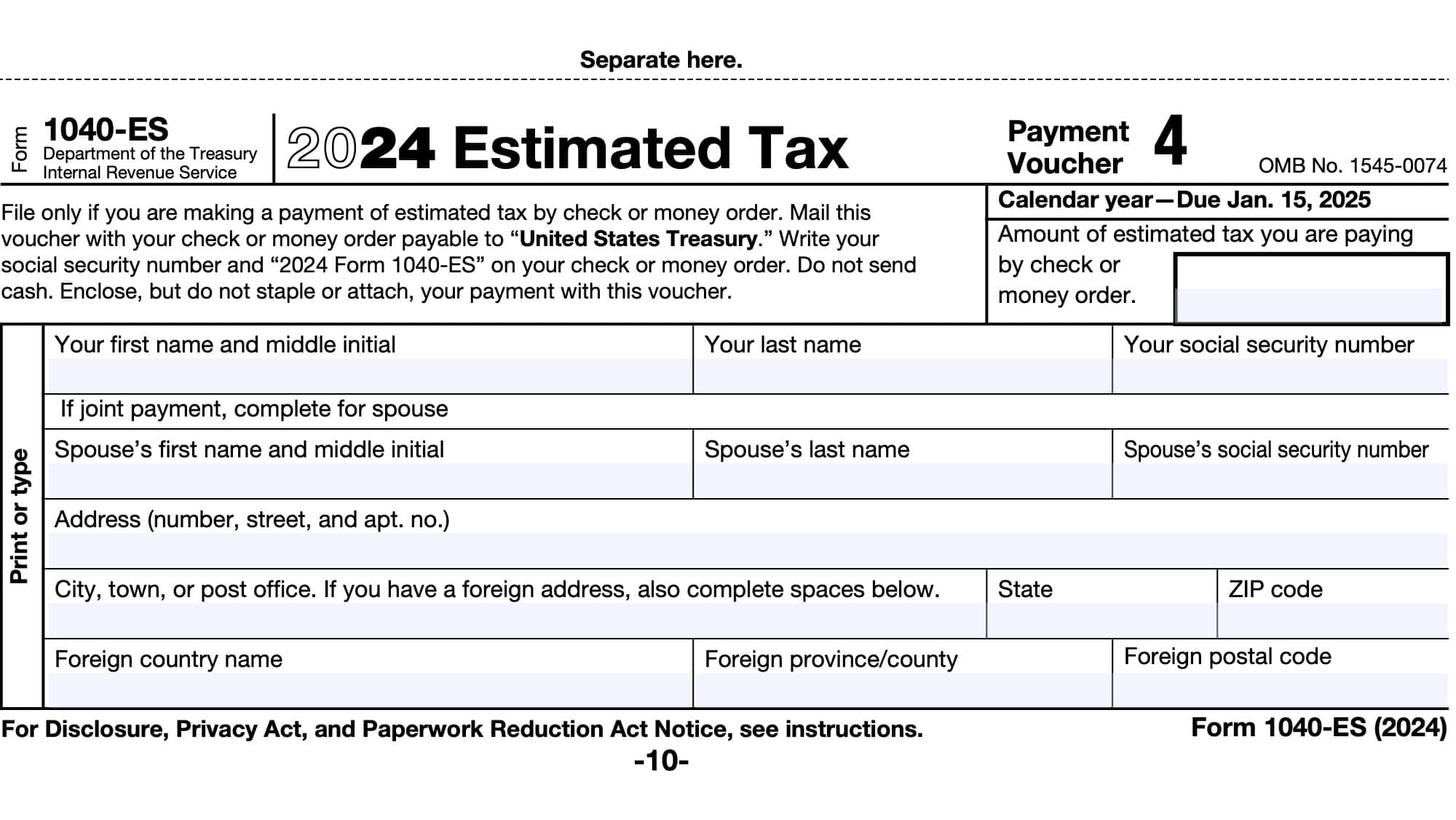

Irs Estimated Tax Payment Forms 2025 Hildy Karrie, The irs announced that taxpayers in texas affected by hurricane beryl that began on july 5, 2025, now have until february 3, 2025, to file. Final payment due in january 2025.

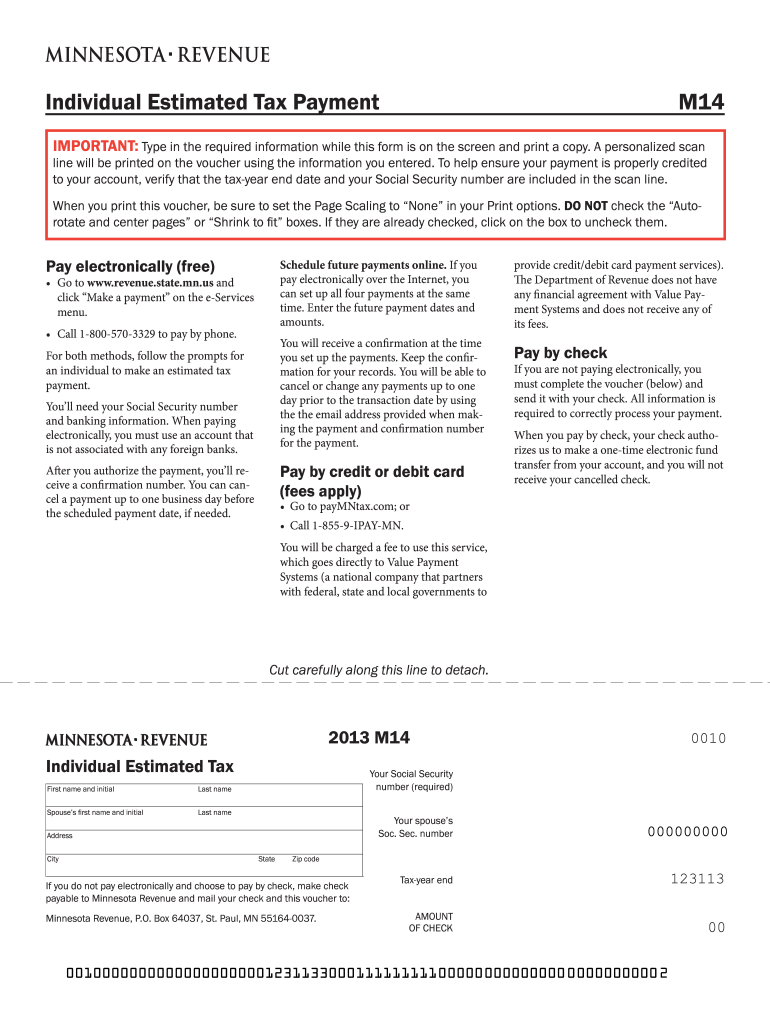

Estimated Tax Payments 2025 Due Schedule Lanna Pietra, Estimated tax payments are periodic payments made by individuals and businesses to the irs throughout the year to fulfill their tax obligations. Estimated tax payments are the taxes you pay to the irs throughout the year to account for income you've earned that wasn't subject to tax withholding.

Irs Estimated Tax Payment Form 2025 Deana Estella, After the end of the year, the corporation must file an income tax. Deposits for the fourth quarter of 2025 are due jan.

Irs Estimated Tax Payment Forms 2025 Genni Heloise, After the end of the year, the corporation must file an income tax. Failing to pay estimated taxes will cost you more in 2025;

Irs Estimated Tax Payment Form 2025 Deana Estella, Irs boosts penalty interest charges to 8% Final payment due in january 2025.

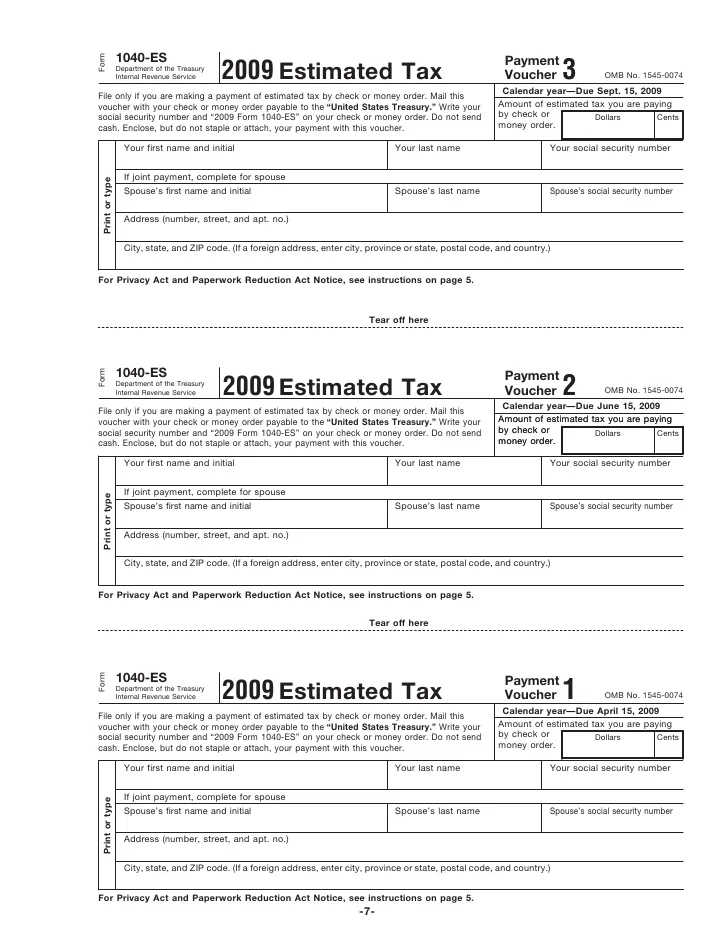

IRS Form 1040ES Instructions Estimated Tax Payments, For the year 2025, the irs has provided guidelines and updates for estimated tax payments. When paying estimated taxes, you.

Irs Estimated Tax Payments 2025 Dotti Gianina, It’s important to note that taxpayers. However, the irs is granting more time for individual taxpayers to pay for quarterly estimated income tax payments normally due on september 16, 2025, and.

How Estimated Taxes Work, Safe Harbor Rule, and Due Dates (2025), Making estimated tax payments on time has benefits beyond maintaining compliance. July 31, 2025, for the second quarter of 2025, and.

Irs Estimated Tax Payments 2025 Worksheet Rayna Delinda, There are four payment due dates in 2025 for estimated tax payments: We’ll break down everything you need to know about irs estimated tax payments, the quarterly tax.