Irs Tax Brackets 2025. The 2025 tax year, and the return due in 2025, will continue with these seven federal tax brackets: 29, 2025, as the official start date of the nation's 2025 tax season when the agency will begin accepting and processing 2025 tax returns.

The irs reports that, as of march, 8, 2025, it had received about 62.8 million tax returns and refunded $135.3 billion to u.s. Again, the 2025 tax season began six days.

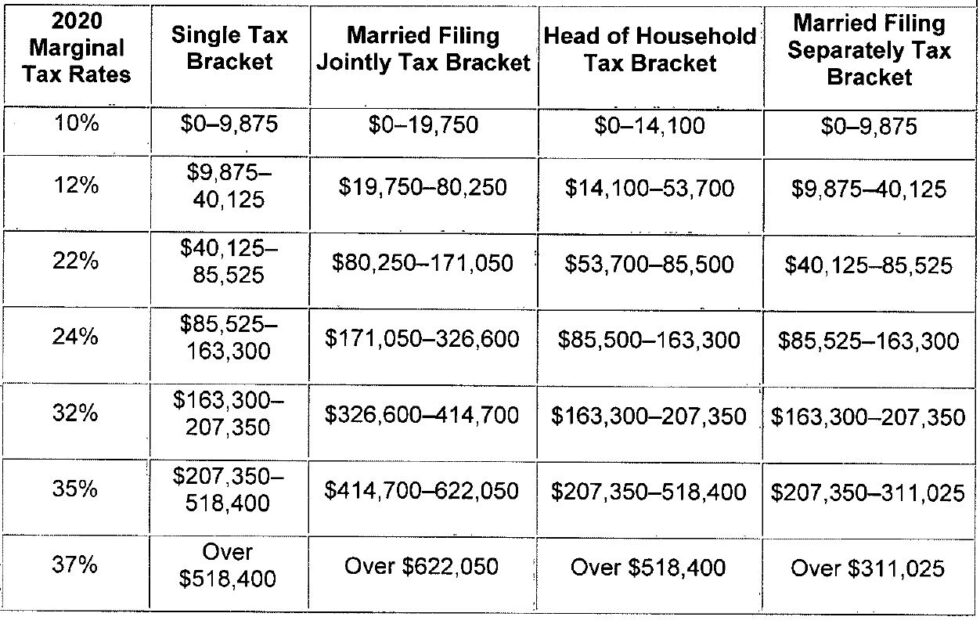

Federal income tax is calculated based on seven tax brackets, which depend on the taxpayer’s income and tax filing status.

2025 tax brackets IRS inflation adjustments to boost paychecks, lower, The top 1 percent’s income share rose from 22.2 percent in 2025 to 26.3 percent in 2025 and its share of federal income taxes. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Here are the federal tax brackets for 2025 vs. 2025 Narrative News, Federal tax brackets and tax rates. The marginal rates — 10%, 12%, 22%, 24%, 32%, 35% and 37% — remain unchanged from 2025.

Federal Tax Earnings Brackets For 2025 And 2025 bestfinanceeye, 29, 2025, as the official start date of the nation's 2025 tax season when the agency will begin accepting and processing 2025 tax returns. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate).

Us federal tax brackets 2025 vaultseka, The internal revenue service (irs) has designated seven federal tax brackets that apply to both the 2025 tax year (the taxes you file in april 2025) and the 2025 tax year (the taxes you file in. Any excess income is taxed at the next bracket.

Tax filers can keep more money in 2025 as IRS shifts brackets Andrews, The irs has adjusted federal income tax bracket ranges for the 2025 tax year to account for inflation. There are seven tax brackets for most ordinary income for the 2025 tax year:

Tax Changes for 2025 What You Need to Know Guiding Wealth, The brackets are summarized below for individual single taxpayers. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent.

Irs Withholding Rates 2025 Federal Withholding Tables 2025, Updated tax rates and brackets. Cumulative statistics comparing march 10, 2025, and march 8, 2025.

2025 Irs Tax Table Chart, Your standard deduction — the amount you can use as a deduction on your 1040 tax return without itemizing — will also be higher. Cumulative statistics comparing march 10, 2025, and march 8, 2025.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, There are seven (7) tax rates in 2025. 2025 tax brackets (taxes filed in 2025) in the united states, we have a progressive income tax that works in conjunction with marginal tax rates.

Federal tax brackets 2025 newyorksilope, The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Cumulative statistics comparing march 10, 2025, and march 8, 2025.